Shankara Capital

We invest to drive the value chain in MRO, Aerospace, and Defense

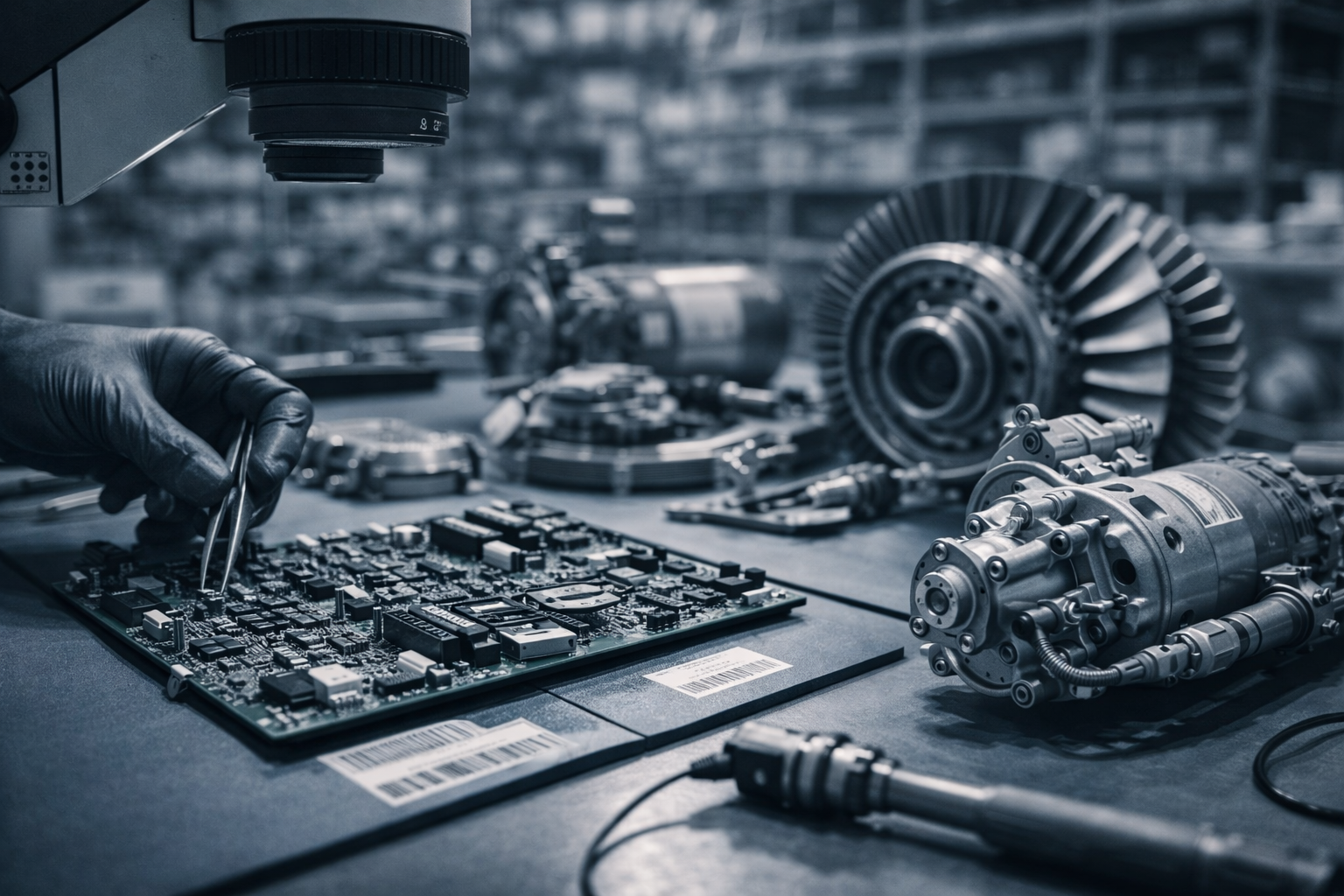

We drive the value chain in Aerospace and Defense, identifying and supporting critical assets in aeronautical services, industrial capabilities, and dual-use technologies, with a focus on capacity, reliability, and industrial sovereignty.

SUMMARY

In a context in which Europe is accelerating investment in defense, aerospace, and technological security, the market is rewarding companies capable of providing capacity, reliability, and industrial sovereignty. This is where Shankara Capital comes in: an investment vehicle specializing in identifying and supporting critical assets in the value chain—aeronautical services, industrial capabilities, and dual-use technologies—with a clear conviction: the winners will not be those who promise the most, but those who deliver the best.

Our thesis is to invest in businesses where competitive advantage is built on real barriers: regulatory requirements, approval cycles, quality requirements, traceability, and long-term relationships. In these sectors, growth requires focus and decisions that unlock milestones: increased capacity, access to programs, international expansion, and greater density of supply.

Shankara Capital seeks companies with proven products or services and the potential to become leaders in their niche if their expansion is accelerated. We are committed to what truly creates value: strengthening capabilities, raising standards, improving efficiency, and consolidating positioning in a market where reputation is a cumulative advantage.

ABOUT US

Shankara Capital is the specialized investment arm of Grupo STIG, operating in strategic alliance with Defence Virtus, a leading consulting firm in strategy, innovation, and digital transformation for the defense and aerospace sectors. Our role is not only to provide financial resources: we accompany companies in processes of professionalization, transformation, and scaling up, strengthening governance and accelerating decision-making with industrial discipline.

We operate with an active management philosophy. We work from the origin of the opportunity to the creation of value in the portfolio. We prioritize models where competitive advantage is sustained by capacity, quality, certifications, processes, and people, elements that are especially critical in regulated and highly demanding sectors. We make direct investments in high-potential companies, participate in specialized funds, and finance high-impact business projects.

OUR APPROACH

Rigorous selection

We evaluate not only figures, but also industrial capacity, equipment, processes, operational culture, and commercial resilience.

Structured growth

Organic expansion + partnerships + selective consolidation, with a focus on margins, cash conversion, and CAPEX control.

Governance and control

Implementation of reporting, dashboards, risk management, compliance, and aligned incentive structure.

What do we do in practice?

- Direct investment in companies and projects with the potential to become leaders in their niche.

- Asset and investment management with a focus on capital preservation and value creation.

- Financial structuring and third-party financing for high-impact projects (vehicles, co-investment, debt/hybrid structures).

- Post-investment support: professionalization, industrialization, purchasing, pricing, operational excellence, and strategic support.

WHAT WE INVEST IN

Maintenance of private and commercial airlines

We invest in companies that provide base and line MRO services for business aviation and commercial airlines, with a focus on airworthiness compliance, certified quality, and high demand recurrence.

Commercial and military aviation

We invest in platforms and suppliers that support logistical sustainability and operational availability in complex environments, both in civil aviation and in defense programs and operators.

MRO equipment and accessories

We invest in companies that supply precision tools, GSE, and critical technical equipment for hangars and workshops, aimed at reducing downtime, improving productivity, and raising safety standards.

MRO Components

We invest in specialists in repair and lifecycle management of rotables, avionics, and hydraulic systems, with certification, traceability, and rapid response capabilities that preserve asset value and improve TAT.

PORTFOLIO

We have a diversified portfolio structure that includes units specializing in aircraft maintenance, high-tech subsystems, MRO component and equipment services, and various suppliers of global market leaders.

Aerospace

Defense

AI & Cybersecurity

We build partnerships by providing strategic capital to drive the aerospace and defense sector forward.

MANAGEMENT TEAM

Joaquín Palma López — Founding partner

Strategic investor, expert in corporate finance, capital structuring, and alliances, driving sustainable growth.

Javier Pérez Temprano — Chief Investment Officer

M&A expert with extensive experience in expanding high-growth projects, with experience in international banking.

Mª Carmen Gutiérrez — Chief Operating Officer

Expert in business administration and management provides operational leadership, control, and process efficiency.

Jose Antonio Rendón — Investment Analyst

An experienced analyst in listed companies and small caps, he brings rigor to analysis and value creation.

CONTACT

If you want to explore opportunities in MRO, Aerospace, and Defense, let’s talk.